How to Spot Employee Theft and What You Can Do About It

Insperity

APRIL 14, 2016

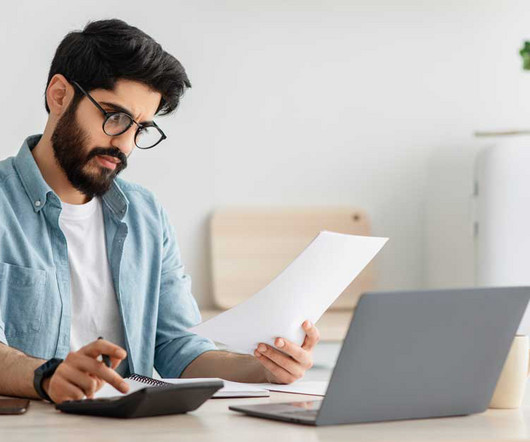

One of the biggest mistakes small business owners make is putting one person in charge of the finances. The person paying the bills should never reconcile the bank statement. Custody of related assets – The person who reconciles the bank statement or credits/edits the invoice. defensiveness when reporting on work.

Let's personalize your content